FREQUENTLY ASKED QUESTIONS

What is Stashlete?

How does Stashlete work?

To get started:

-

Sign up on the Stashlete app or website.

-

Select a nonprofit(s) that resonates with you.

-

Choose your giving method—one-time, monthly, or round-up on purchases.

-

Link your debit or credit card securely through Stashlete.

-

Start giving—as you spend or on a set schedule, your contributions automatically support your nonprofit.

Stashlete account

You can create a Stashlete account by visiting the Stashlete website at www.stashlete.com or our web application at app.stashlete.com.

Where is Stashlete available?

Stashlete is currently available only in the United States. We are planning to expand internationally soon, so please check back for updates!

Which organizations can I donate to with Stashlete?

With Stashlete, you can donate to any U.S.-based 501(c)(3) nonprofit registered and verified with the IRS, giving you access to over 1 million charities to support. If you can’t find a specific nonprofit, reach out to us at contact@stashlete.com, and we’ll work to verify and add the organization for you.

Is my payment transaction secure?

Yes, Stashlete relies on Stripe for payment processing. Stripe is certified to the highest compliance standards, ensuring your payment information is secure and protected.

How are my donations sent to my selected nonprofit organization?

Your donations through Stashlete are deposited directly into your nonprofit’s bank account or sent via check through our donation administrator. Since Stashlete partners with verified U.S. 501(c)(3) charities, your contributions qualify as charitable donations for U.S. tax purposes. We recommend consulting your tax advisor for guidance on all tax-related matters.

Are there any fees to use Stashlete?

As a donor, using Stashlete is free, and 100% of your donation qualifies as a charitable deduction.

Nonprofits are charged a platform fee of 10% to cover transaction costs, payment processing, reporting, and ongoing tech support. If a donation requires additional processing, such as disbursement via check, there may be an extra administrative fee.

Do I receive a tax donation receipt for 100% of my donations?

Yes, since no goods or services are provided in exchange for your donation, the full amount qualifies as a charitable contribution for U.S. tax purposes. We recommend consulting with your tax advisor for specific tax-related questions.

Is there a minimum amount required each month?

Yes, Stashlete requires a minimum donation of $1 per month for all one-time, fixed monthly, or round-up donations.

When does my donation get processed?

Recurring round-up and fixed monthly donations are processed on approximately the first business day of the following month. One-time donations are processed immediately.

Can I donate to more than one charity?

Yes, Stashlete allows you to support multiple nonprofits at once by creating a giving portfolio. You can select multiple entities to give to, and manage your contributions within your portfolio for ongoing support to each organization.

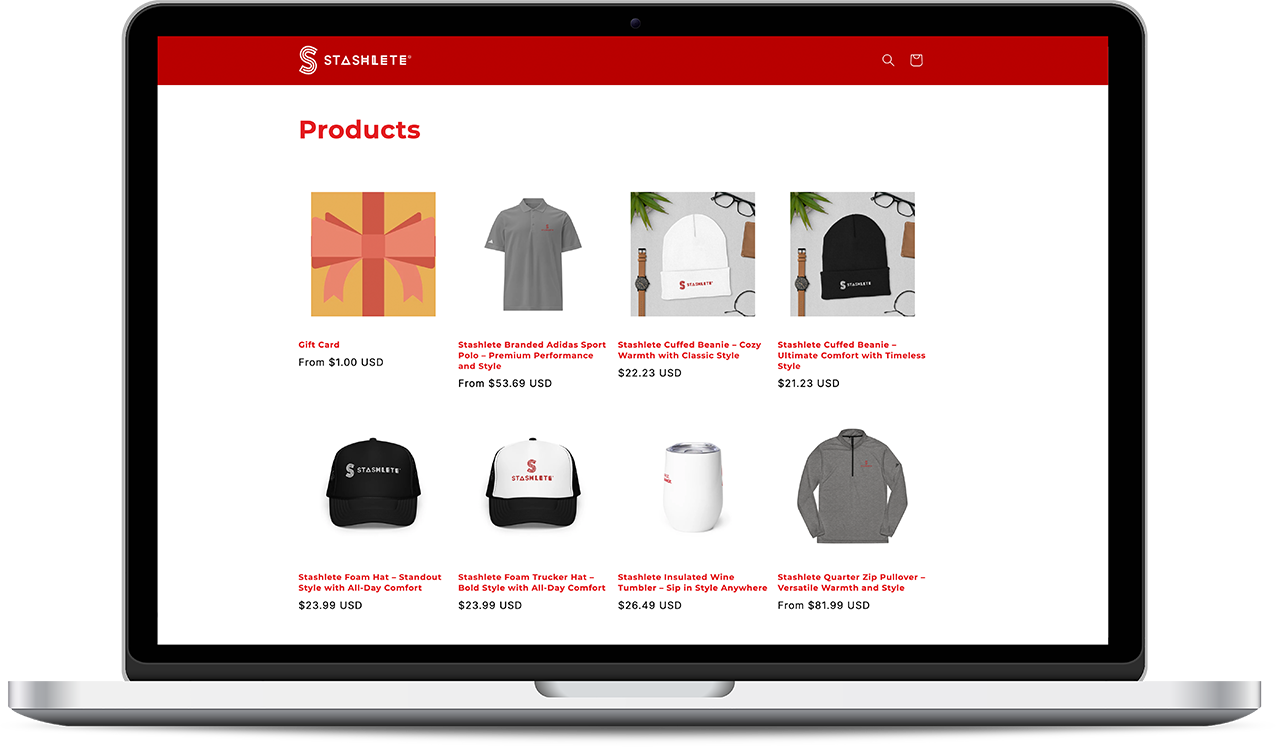

FUEL YOUR CAUSE

with Stashlete Gear, Gifts, and a Whole Lot of Good Vibes!

We are proud to offer a unique collection of branded merchandise chosen exclusively for you.